Update your banking software.

Synchronise your accounts.

You can usually find this option in the settings for your login data. If you have not yet logged in to online banking following the upgrade, you may be asked to do so. In online banking, a setup wizard guides you conveniently through the individual steps.

Important: If you have already created a new Deutsche Bank ID in Deutsche Bank online banking, update the user ID in your banking software. The same applies to the PIN or password.

Check whether photoTAN is selected as the standard procedure in your banking software.

The mobileTAN procedure will no longer be valid following the upgrade. If you have already set up BestSign as a security procedure (only possible since 25 August 2025), select this as the default procedure.

Perform authorisation again.

Due to the system upgrade, you have to authorise yourself again using photoTAN or BestSign. You are prompted to do so every 90 days.

Your new banking system

Since 25 August, you will benefit from the upgrade to online banking and Deutsche Bank app. Look forward to simpler navigation and many new features that will make your daily banking transactions even more convenient.

We are continuously updating the site, so do not hesitate to keep checking back here.

Experience now: more comfort for your banking

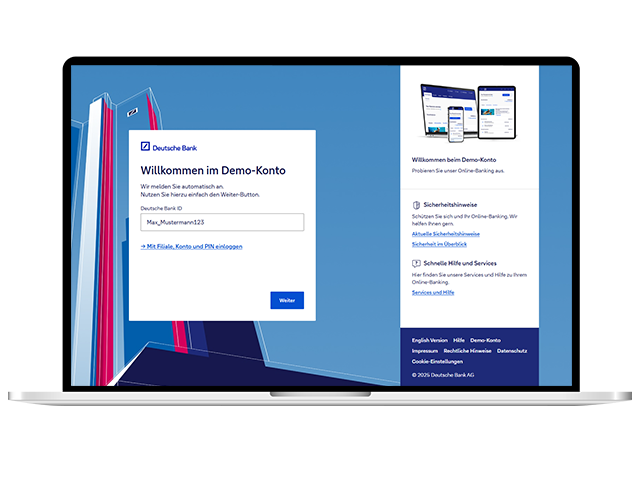

With our demo account, you can discover the advantages of the new banking.

This is what you need for your first login

Your 5-digit PIN for online banking

Your active photoTAN procedure

How to log in to online banking and the app for the first time

- If you have installed the Deutsche Bank app, please ensure that you are using the latest version.

- When you first open the existing app, you will usually be notified of the necessary update.

- If you have disabled automatic updates, you can update the Deutsche Bank app via the App Store or Play Store.

Please select the instructions that are right for you, depending on how you use our online banking:

I have one branch/account number that only I can access.

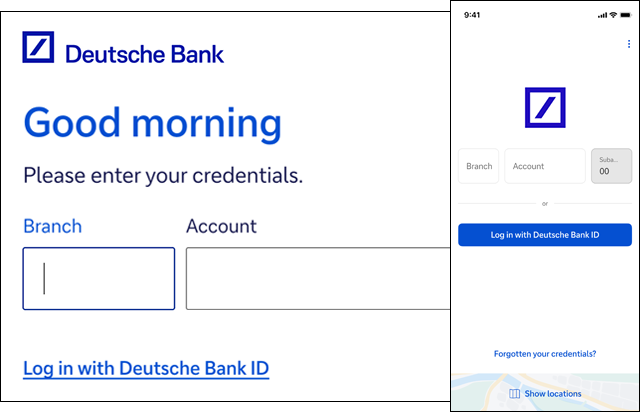

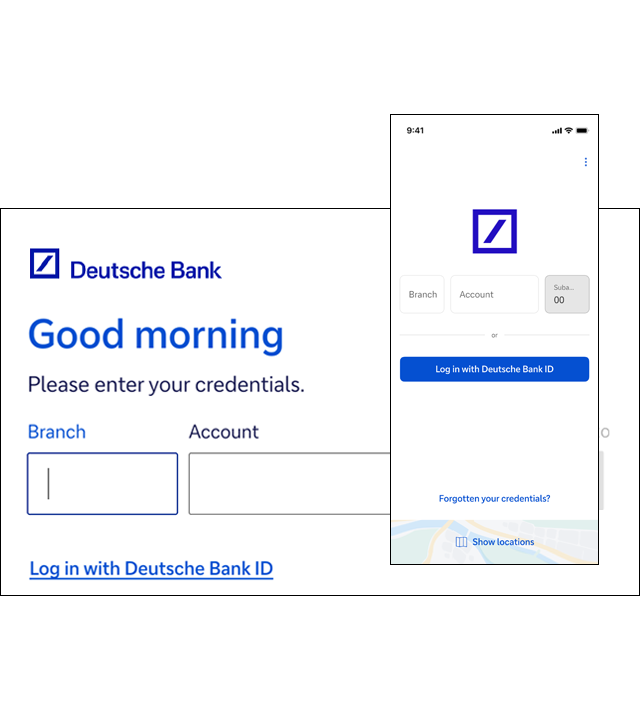

How to log in

-

Enter branch/account number

You log in with your branch/account number. New: The 2-digit sub-account number is no longer required.

-

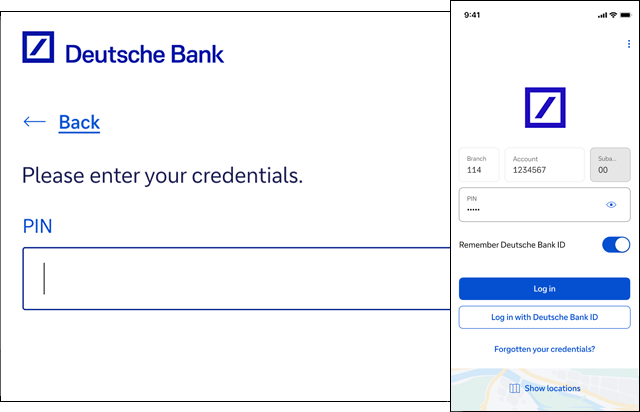

Enter PIN

Enter your 5-digit PIN.

-

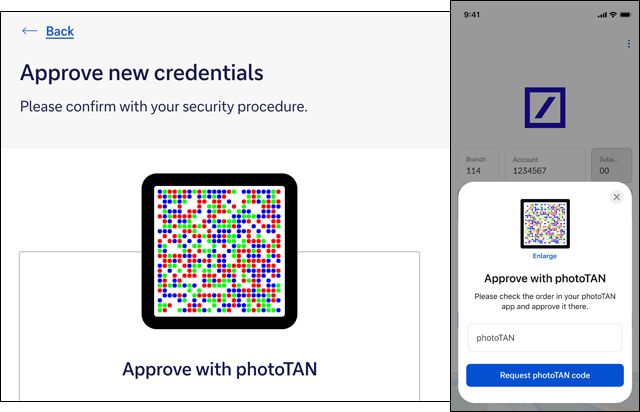

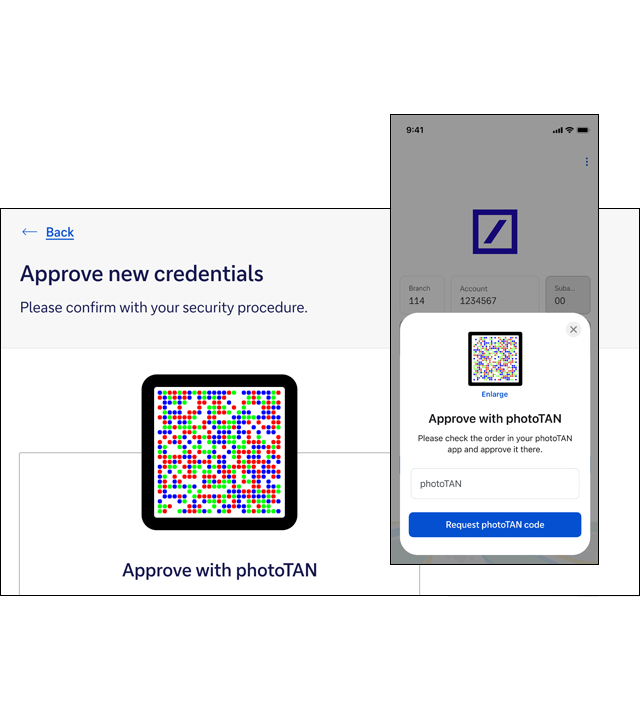

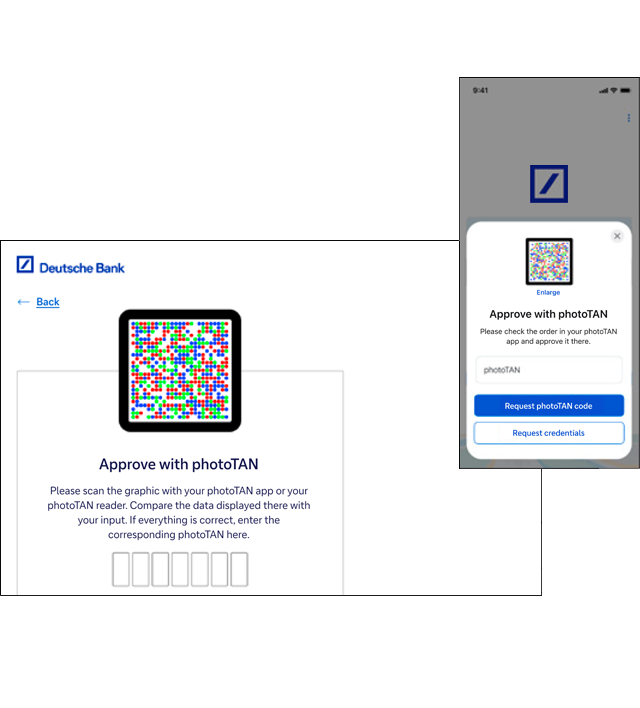

Approve with photoTAN

Finally, confirm your input with photoTAN or photoTAN push.

New: You can set your own credentials

After logging in for the first time, you will still be able to use your branch/account number and your PIN to log in. Your branch/account number is now your Deutsche Bank ID and your PIN is your password.

In contrast to the branch/customer number, the Deutsche Bank ID is not linked to individual accounts, but is uniquely assigned to you as an individual. This means that after logging in, you can also see accounts for which you are an authorised signatory.

You can change your Deutsche Bank ID and password at any time in online banking or in the app.

I have several branch/account numbers and/or several persons are authorised signatories.

How to log in

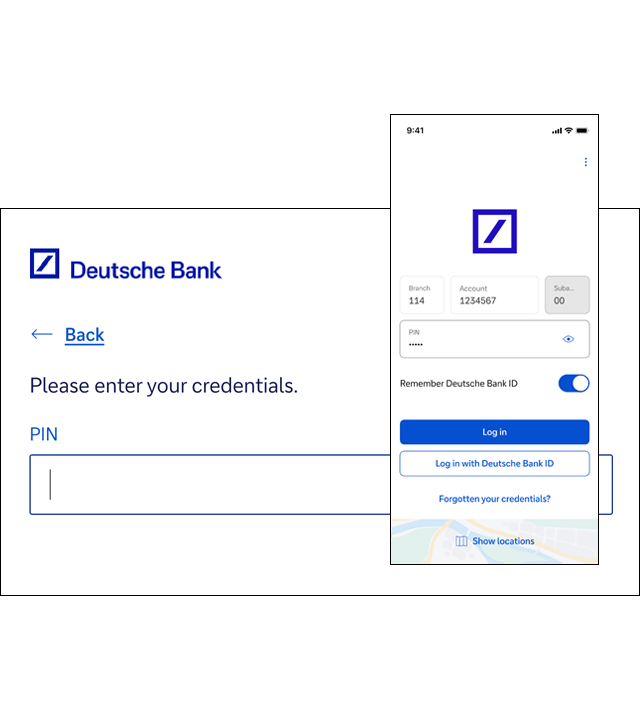

-

Enter branch/account number

You log in with your branch/account number. New: The 2-digit sub-account number is no longer required.

-

Enter PIN

Enter your 5-digit PIN.

-

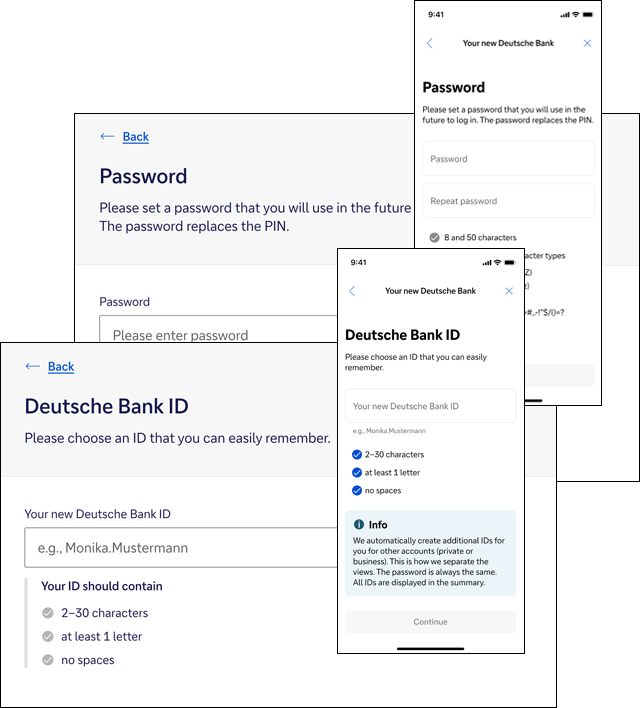

Use the setup wizard for new credentials

Step by step, you choose new credentials: Your personal Deutsche Bank ID and password.

-

Approve with photoTAN

Finally, confirm your input with photoTAN or photoTAN push.

New: Your Deutsche Bank ID and password

When you log in for the first time, you choose your Deutsche Bank ID and password. These credentials replace the branch/customer number and PIN. Alternatively, you can choose new credentials – as your Deutsche Bank ID.

The Deutsche Bank ID is not linked to individual accounts, but is assigned to you as an individual. This means that after logging in, you will also see accounts for which you are authorised or an authorised signatory. You can hide distracting accounts in the financial overview or exclude them from the balance calculation.

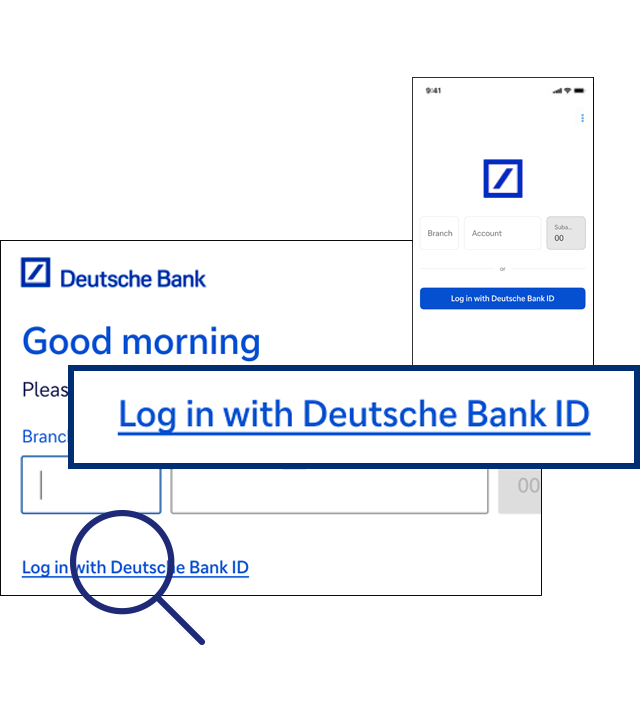

I also use Postbank Online Banking.

How to log in

-

Direct login

Click directly on "Log in with Deutsche Bank ID"

-

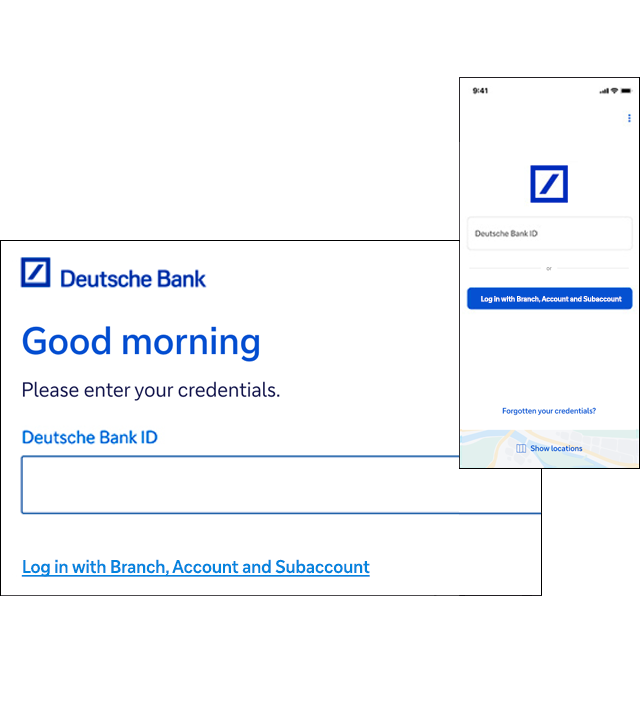

Enter your Postbank ID…

Enter your ID that you also use for Postbank online banking and app.

-

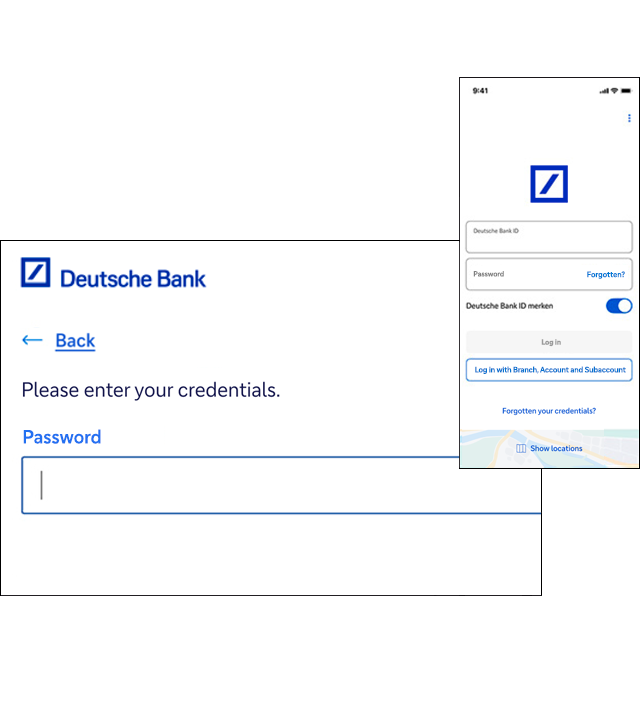

… and your Postbank password

Once you have entered your Postbank password, your new access data will be complete.

-

Approve with photoTAN

As a last step, confirm your entries with photoTAN or photoTAN push.

New: Your ID and your password

The login details you also use for Postbank online banking replace your branch/customer number and PIN. Your ID is not linked to individual Deutsche Bank accounts, but to you as a person. This means that after logging in, you will also see Deutsche Bank accounts for which you have power of attorney or authorisation. In the financial overview, you can hide accounts or exclude them from the balance calculation.

Security procedures for the new banking

photoTAN

Are you already a Deutsche Bank customer and have an active photoTAN procedure? Then you can continue to use it as usual – a switch to BestSign is not necessary. Only when you change to a different smartphone, you will need to switch to BestSign.

BestSign

Are you new to Deutsche Bank or do you need a new activation, e.g. due to a device change? Then please set up our new BestSign security procedure.

To do this, please connect your banking in your browser or in the app to the BestSign procedure. With the BestSign procedure, you approve your orders with a digital signature. It's simple, secure and fast.

Discontinuation of mobileTAN

mobileTAN can no longer be used for banking from 25 August. From this point onwards, you will no longer receive transaction numbers (TAN) by SMS to approve transfers or other transactions.

The main benefits of your new online banking

New design for more convenience

In addition to a clear navigation, your banking offers you many new features that will make your daily banking even more convenient.

More accounts at a glance

After logging in with your Deutsche Bank ID, you see all products in the financial overview, such as current account, securities account, loan or investments. Accounts for which you are an authorised signatory are also displayed.

Individually adjustable total balance

You can customise the financial overview. You decide which accounts you want to see in the financial overview and which you do not.

More online services

With over 70 online services, you are able to do almost all your banking business from your PC or smartphone: Change your address or the transaction limit, create new authorised signatories and much more.

The main benefits of your new Deutsche Bank app

Your code for cash

With the cash code (‘Bargeld-Code’), you can withdraw cash from individual accounts throughout Germany.1 At the end of this year, this will also be possible from joint accounts. At 12,500 locations without shopping, without an ATM. Simply with your Deutsche Bank app.

Pay by smartphone

Pay conveniently and securely with Google Pay and Apple Pay. Google Pay replaces Mobile Payments with Android. Cards that you have used for Mobile Payments with Android must be re-registered in Google Pay.

Manage your credit cards

You will see all your credit cards in your new Deutsche Bank app. Transactions are displayed directly. You can adjust card limits online. This makes it even easier for you to keep track of your finances.

1 Withdrawing cash is free of charge. A fee of 1.5% of the deposit amount applies for deposits.

The Deutsche Bank app can do even more

Intuitive navigation, clear functions and much more – all in one app. Find our more (only in German)

FinTS

If you use FinTS software for your banking business, please note the following information.